Governance and Oversight

Highlights

- The Board of Directors holds 10 regularly scheduled full board meetings each year, typically at the company headquarters in Madison, Wis.

- Seven out of the board’s nine directors are independent. All members of the Corporate Governance Committee, Audit Committee and Compensation Committee are considered independent.

- The Lead Independent Director is empowered to call meetings of the board and executive sessions and chairs the Corporate Governance Committee.

- The Corporate Governance Committee conducts an annual assessment of the board’s effectiveness as a whole.

- The company has a “clawback policy,” which covers both cash-based and/or stock-based awards containing performance requirements.

- Bylaws include a director resignation policy for directors who do not receive a majority “for” vote in uncontested elections.

- The board engages in a comprehensive risk assessment and mitigation review biannually, and on a biennial basis, the board conducts a broad-based exercise with all company officers on risk.

- MGE does not use corporate funds for contributions to any state or federal political candidates or their campaign committees.

Our Board of Directors has a commitment to corporate responsibility and accountability. Community-focused and with a breadth and diversity of experience, board members bring strong, effective oversight in their service to MGE and MGE Energy.

Board engagement

Our board is very active and engaged with 10 regularly scheduled meetings of the full board each year, in addition to committee meetings. These meetings help directors stay well-informed of industry and company developments.

Board meetings are structured to provide for regular presentations and active dialogue with MGE management. Internal and external subject matter experts present to the board on issues of strategic importance to inform board members’ decision-making and oversight.

In the past year, the board engaged internal and/or external subject matter experts on a wide range of topics. Included among the topics discussed by the board are the following:

- Analysis of MGE’s net-zero carbon goal by experts at the University of Wisconsin-Madison

- Planned retirement of the Columbia Energy Center and future energy and capacity needs

- COVID-19 pandemic and related impacts

- Cybersecurity

- Environmental, social and governance (ESG) reporting and disclosures

- Generation strategy and planning

- Utility rates

- Matters of social justice and of diversity, equity and inclusion

- Issues of human rights and labor abroad in energy and related industries

- Federal regulation and legislative matters affecting energy

Strategic planning

In fall 2020, the board held a strategic planning and review session with all officers of the company. These periodic sessions with all officers are designed to review corporate strategy across all aspects of the company’s business and to provide directors with the opportunity to engage the entire senior management team on issues of strategic importance, such as generation strategy and planning.

Effective oversight

Directors understand corporate responsibility and sustainability are integral to the company’s long-term success and share management’s commitments in these areas, from long-term and strategic direction to day-to-day business practices companywide. Each director is expected to examine all major issues affecting an organization and must be committed to the highest ethical standards, accountability, transparency and open dialogue with one another and with management to provide effective oversight.

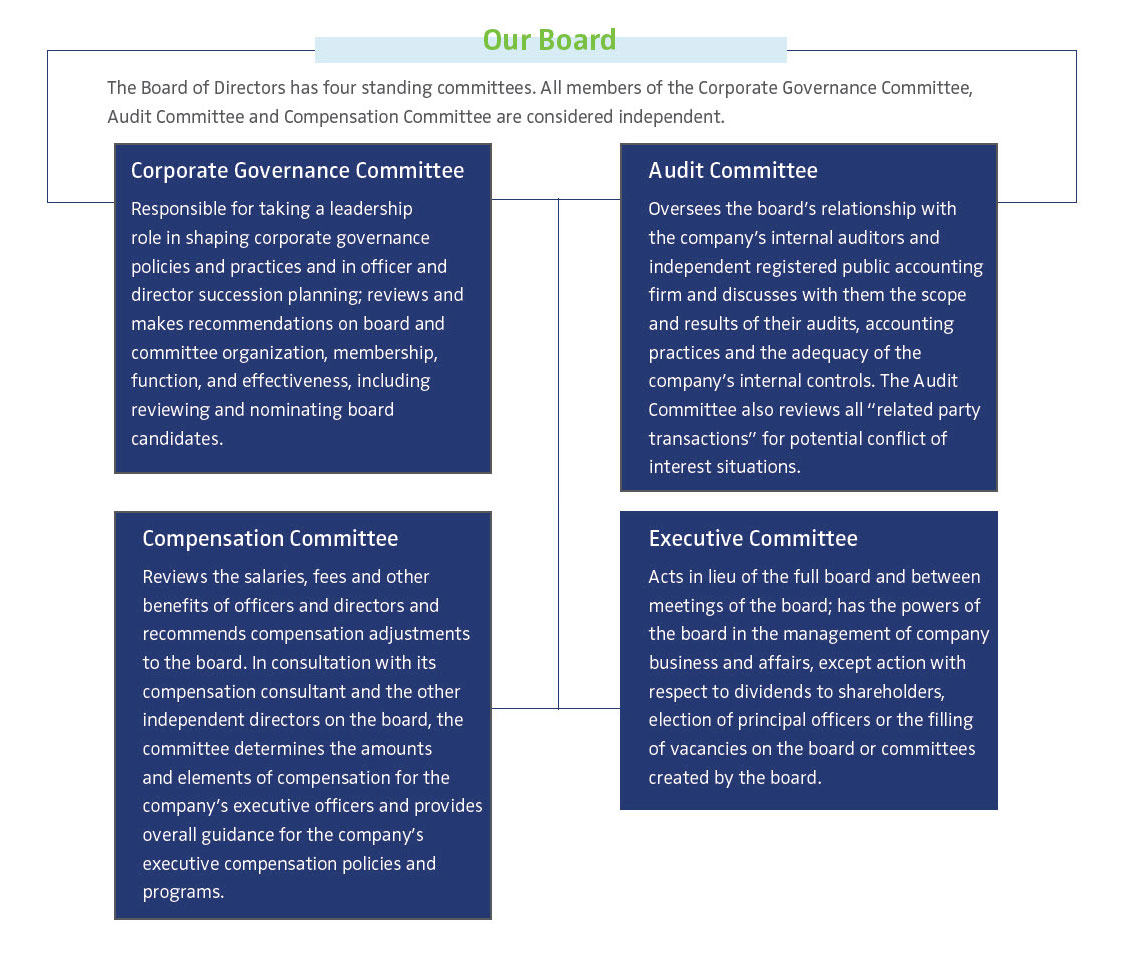

The board has four standing committees. All members of the Corporate Governance Committee, Audit Committee and Compensation Committee are considered independent.

The Executive Committee acts in lieu of the full board and between meetings of the board. The Executive Committee has the powers of the board in the management of the business and affairs, except action with respect to dividends to shareholders, election of principal officers or the filling of vacancies on the board or committees created by the board. Since the board meets 10 times a year, the Executive Committee has not needed to meet or to take action.

Oversight of ESG matters

Board oversight includes review of environmental risks and mitigation as well as assessment of current and/or future environmental regulations. It also includes review of the company’s environmental and sustainability performance.

MGE’s employee-led Sustainability Steering Team serves to help ensure the company takes a global and proactive approach to sustainability throughout the organization. The Sustainability Steering Team is overseen by MGE’s Executive Sustainability Team, which has officer representation from across MGE and which keeps the board of directors informed of the company’s progress. More information about the structure and purpose of the Sustainability Steering Team is available in the Employees, Customers and Communities section of this report.

In 2018, MGE moved from biennial to annual production of our Environmental and Sustainability Report, which in 2020 became the company’s Corporate Responsibility and Sustainability Report to reflect more accurately the range of content provided in the report. This report is reviewed by the board every year.

Our Board

In 2018, MGE also began publishing the Edison Electric Institute’s (EEI) voluntary and industry-specific environmental, social, governance/sustainability reporting quantitative template. The quantitative template includes data related to MGE’s energy portfolio (generation and capacity), emissions, capital expenditures, and human and natural resources.

EEI’s qualitative template includes information related to the company’s strategies for transitioning toward deep decarbonization and greater sustainability. Board members also review annually these reporting templates, which are created to advance transparency and disclosure in company operations.

Oversight of executive compensation

MGE Energy’s Board of Directors’ Compensation Committee, composed of independent directors, takes into consideration performance on both short- and long-term corporate strategy, among other factors, when evaluating executive compensation. Directors consider environmental performance, among other factors, such as cost containment and management of day-to-day operations.

The committee also considers other performance goals that are critical to company performance, such as earnings, system reliability and customer satisfaction as well as long-term strategic goals, including those related to sustainability. The board regularly reviews how well the company is advancing its goals for carbon emissions reductions as well as progress on its specific strategies for deep decarbonization.

Our compensation program is designed to link a significant portion of the compensation of our named executive officers to defined performance standards that promote a balance of the drive for near-term earnings and returns with growth in long-term shareholder value. The board believes that directors and officers should own and hold the company’s common stock and have a portion of their compensation based upon the performance of that common stock to align further with the long-term interests of shareholders. The company’s guidelines measure that alignment through a combination of minimum stock ownership and long-term compensation awards that are directly tied to the performance of MGE Energy stock.

MGE Energy’s annual Proxy Statement provides a full explanation of the company’s corporate governance practices and responsibilities. It is available at mgeenergy.com/proxy.

State and federal oversight

As a public utility, MGE operates under state and federal regulations. These regulations serve to protect the interests of customers, employees, investors and the environment. MGE is subject to regulation by the Public Service Commission of Wisconsin, which has authority to regulate most aspects of MGE’s business, including rates, terms and conditions of service, accounts, issuance of securities and construction of infrastructure, such as generation siting.

The Federal Energy Regulatory Commission has jurisdiction, under the Federal Power Act, over certain accounting practices and certain other aspects of MGE’s business. MGE Energy’s subsidiaries also are subject to regulation under local, state and federal laws regarding air and water quality and solid waste disposal.

Risk management

Enterprise-wide risk assessment and oversight are fundamental responsibilities of our board. Directors are involved in the process of overseeing the primary risks facing the company.

As part of the company’s Enterprise Risk Management program, our board receives on an ongoing basis information from management related to key business risks and mitigation strategies. These business risks include existing and emerging risks related to environmental performance and sustainability, among other risks.

The company’s Internal Audit department, on behalf of MGE management and the Board of Directors’ Audit Committee, conducts an annual Enterprise Risk Management meeting with each officer of the company. The sessions with individual company officers and management update existing areas of risk, classify new or emerging areas of risk and identify owners responsible for assessing, managing and/or mitigating areas of risk.

In addition, the board engages in a comprehensive risk assessment and mitigation review biannually. And, on a biennial basis, the board conducts a broad-based exercise with all company officers on risk and emerging risk identification, assessment and mitigation strategies. This review last occurred in fall 2021.

The company’s comprehensive approach to risk management encourages all directors to initiate discussion at any time, either directly or through the Lead Independent Director, on any areas of concern, including risk identification and assessment, controls, management and oversight. The board and MGE management have created a culture of sustainability, responsibility and risk management. All officers of the company take ownership in and are accountable for managing and mitigating corporate risk.

Environmental Management System

In 2017, MGE expanded the scope of its renewed five-year contract with the Wisconsin Department of Natural Resources for its Green Tier certification, which recognizes environmental leadership. The primary goal in the expanded contract is to cover all MGE operations under the company’s Environmental Management System (EMS).

MGE has employed an independent third party to oversee the expansion of the EMS. The independent third party’s expertise in risk management and compliance is helping MGE to identify operational and environmental risks and to evaluate those risks under the scope of the expanded EMS. The EMS has a risk profile or scoring convention to evaluate risks consistent with how the company assesses risk throughout the organization. The EMS process helps to ensure effective identification, assessment and management of risk at all levels of the organization. MGE’s commitment to the EMS process, which is audited annually by a third party, further demonstrates the company’s commitment to goal-setting and to environmental accountability in corporate governance. More information on the EMS is available under “Comprehensive risk minimization” in the Safety and Operations section.

Ongoing board education

The board’s regular interactions with internal and external subject matter experts provide useful information and insight relative to critical business initiatives and corporate strategy. These interactions inform the board’s understanding of the company’s financial performance, environmental performance, risk management and oversight, and succession planning.

Board members also have direct access to a network of resources and ongoing educational opportunities that support their ability to provide effective oversight and governance on a broad range of critical issues. This direct access includes director training and resources from:

- The National Association of Corporate Directors, an organization dedicated to advancing broad-based director education, including on governance and emerging issues;

- PricewaterhouseCoopers (PwC), which offers events and resources for directors to stay current on environmental, social and governance (ESG) topics, risk, and other board responsibilities; and

- The Edison Electric Institute (EEI) and the American Gas Association (AGA), which also offer ESG-related topics specific to the energy industry.

Board assessment

The board conducts an annual board self-assessment, which includes an extensive survey covering board structure, meetings, committees, key responsibilities, and board management. In addition, the board periodically evaluates directors’ expertise and experience. A peer evaluation occurs before nominating slates of directors for election and as part of succession planning to consider and to choose new directors.

Climate change and environmental expertise

The board has engaged and plans to continue to engage widely recognized scientific experts on topics related to climate change. This is in addition to the board’s and company management’s regular engagement on emerging environmental risks and risk mitigation from internal subject matter experts. MGE management brings considerable environmental expertise as well as expertise in environmental law to the company.

Partnership with the UW-Madison

In 2019, MGE management began working with experts from the UW-Madison’s Nelson Institute for Environmental Studies to evaluate the company’s net-zero carbon by 2050 goal in the context of the October 2018 special report on global warming of 1.5 degrees Celsius by the Intergovernmental Panel on Climate Change. In early 2020 and 2021, the board discussed the work of these experts to evaluate the company’s goal and strategies for achieving deep decarbonization by mid-century. See the Strategy and Climate section of this report for details of this independent analysis.

MGE continues to work with these experts at the UW on further study of deep decarbonization strategies. This continued partnership includes the analysis of health benefits resulting from air quality improvements related to local energy system changes, including changes to transportation systems.

Board independence

The board makes an annual assessment of the independence of directors under the independence guidelines adopted by Nasdaq Stock Market, Inc. Those guidelines are generally aimed at determining whether a director has a relationship which, in the opinion of the MGE Energy board, would interfere with the exercise of independent judgment in carrying out director responsibilities. The guidelines identify certain relationships that are considered to affect independence, such as a current or past employment relationship with the company, the receipt by the director or one of his or her family members of compensation in excess of $120,000 from the company for other than board or board committee service and commercial relationships exceeding specified dollar thresholds. These guidelines also are reflected in MGE Energy’s Corporate Governance Guidelines, which are available at mgeenergy.com/governance.

The board has determined that seven of the nine directors are independent under the Nasdaq Stock Market, Inc., definition of independence and the company’s Directors Independence Standards, which parallel the Nasdaq Stock Market, Inc., definition. All members of the Corporate Governance Committee, Audit Committee and Compensation Committee are considered independent.

More information about the board is available in the company’s annual Proxy Statement at mgeenergy.com/proxy.

Code of Ethics

The board has a Code of Ethics applicable to all directors, officers and employees of the company. The company’s Code of Ethics includes conflict of interest; confidential and insider information; gifts, gratuities and favors; proper accounting and reporting; outside employment; government relations; political contributions and political office; company property; and reporting illegal or unethical behavior. To review the company’s Code of Ethics, visit mgeenergy.com/governance.

Political engagement and lobbying

MGE advocates on behalf of our customers, shareholders and employees at the local, state and federal levels of government for policies that support safe, reliable, affordable and sustainable energy. We comply with the MGE Code of Ethics as well as all political giving, lobbying, regulatory and disclosure laws in these processes.

Political contributions

State and federal laws prohibit the company from making direct or indirect contributions of corporate funds or resources to any candidate running for political office in the United States or state of Wisconsin. As such, MGE does not use corporate funds for contributions to any state or federal political candidates or their campaign committees.

Though state and federal law allows it, MGE does not have a state or federal political action committee (PAC).

Wisconsin law does allow businesses to facilitate political contributions by their employees via a “conduit” account. MGE administers an MGE Employee Conduit for employees who prefer to use this mechanism for their contributions. All funds contributed through this conduit are made and controlled by individual employees and not by MGE. That is, all contribution decisions are made by the individual employee.

Political office

MGE permits and encourages employees to participate in the democratic process, including running for public office and other related activities provided those activities do not interfere with their work performance or duties, consistent with our Code of Ethics.

Employees also may make contributions to a variety of political candidates and/or PACs, apart from the MGE Employee Conduit. MGE does not, and should not, track all political contributions made by its employees.

Lobbying

As your community energy company, we advocate for our customers, shareholders and employees by building and maintaining relationships with policymakers; by working collaboratively with internal and external stakeholders to identify and address matters that impact our industry, goals and corporate strategies; and by building coalitions with stakeholders, trade associations, employees, customer groups, utility associations and others to pursue and achieve common goals.

MGE employs registered lobbyists and utilizes external lobbyists to engage policymakers at the local, state and federal levels to monitor legislation and policy proposals and to advocate for positions that are in the best interest of our employees, customers and shareholders. Reports of our lobbying activities (MGE Energy and/or MGE) can be found at the federal, state and local levels.

Wisconsin lobbying reports can be found at the Wisconsin Ethics Commission, lobbying.wi.gov. MGE typically does not incur lobbying expenses at the federal or local level that would trigger a lobbying report; however, if it does, those expenses can be found at lda.senate.gov and lobbyingdisclosure.house.gov and at cityofmadison.com/clerk/lobbyists, respectively.

Trade organizations

MGE belongs to a number of trade organizations and coalitions that provide expertise, training and research concerning important industry topics. Some trade associations also participate in the political process, including participating in lobbying. MGE does not control the political activity of its member trade associations, and in fact, may sometimes disagree with political positions taken by them. Trade associations must identify the portion of association dues used for lobbying and political activities to comply with tax rules.

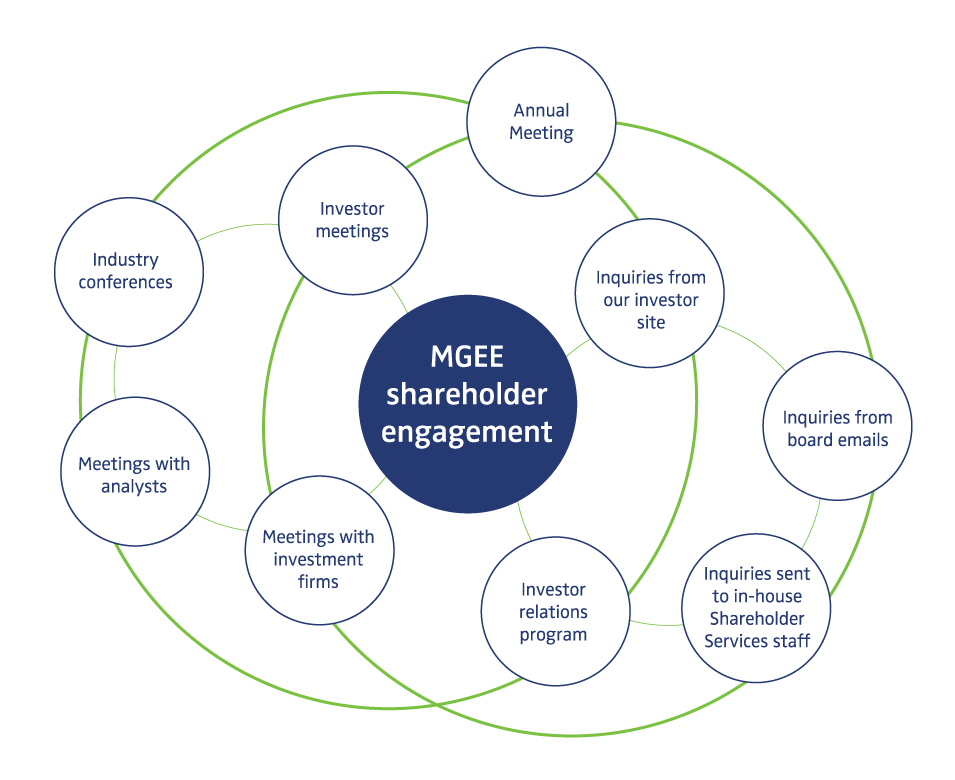

Shareholder engagement

Our board believes that understanding and considering shareholder perspectives advances accountability and transparency. Our investor relations efforts also help executive management and the board understand how investors view the company’s policies and practices, strategies and long-term direction, and help leadership assess and address investors’ emerging areas of interest, such as ESG-related topics.

Officers engage shareholders in several ways, including through discussions with a number of our institutional shareholders; presentations at industry conferences and investor meetings; meetings with analysts and investment firms; our Annual Meeting; and inquiries taken through the company’s investor site, board email and in-house Shareholder Services staff. These efforts are in addition to the company’s regular and ongoing investor relations program.